3 Strategy to Make Money with Your Credit Card Step by Step

Did you know that a credit card could be your secret weapon to making passive income? That’s right! Most people think credit cards are just for spending money and I know many have used them where it has caused them to end up in credit card debt and messed up their credit.

But today, I’m going to show you in this article exactly how you can EARN money strategically with a credit card and not end up in credit card debt. No gimmicks, no risky schemes—just smart strategies anyone can follow.

So continue reading, because by the end of this article, you’ll have the tools and understanding of how a credit card can turn into a passive income machine.

Let’s start with the basics: Credit card rewards types. Many banks that offer credit cards offer cashback, points, or miles for every dollar you spend.

Here are the three main types of rewards:

- Cashback: Earn a percentage of your spending back as cash.

- Points: Redeemable for gift cards, travel, or even statement credits.

- Miles: Perfect for frequent travelers—use them to cover flights and hotels.

The trick is knowing which one works best for your goals. I personally focus on cashback because it’s the most flexible—it’s like getting free money for spending money I’d already be spending!

However not all credit cards are created equal. The right card for you depends on where you spend the most money.

For example, I use my credit card that gives me 2% cashback on groceries and that offers 3% on online purchases.

This way, I’m maximizing rewards on the things I am already buying every day. So now let’s delve into these strategies.

Strategy 1:

1. Take Advantage of Signup Bonuses Credit Cards

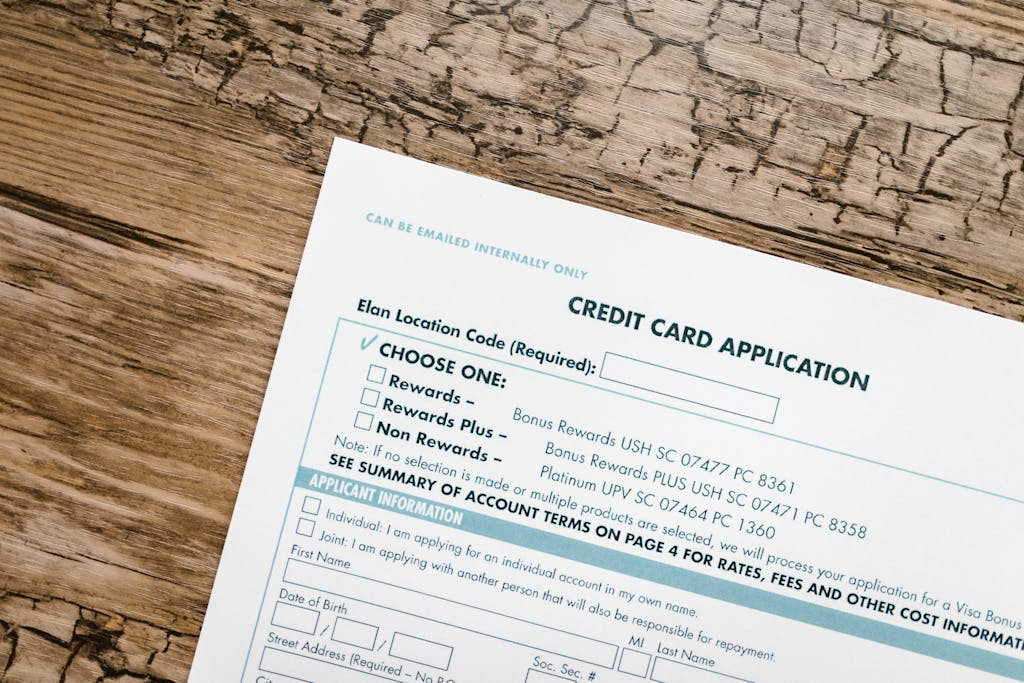

If this is you and you currently don’t have a credit card you can visit any local bank in your area and apply for a credit card.

Many credit cards will give you a welcome bonus—like $200 cash bonus—if you spend a certain amount, say $1,000, in the first three months of using your new credit card.

Now, I’m NOT saying go crazy and buy things you don’t need. I simply mean plan your big purchases around these bonuses.

For example, if I know my car insurance payment is due or I have to buy a new appliance, I’ll use my credit card to hit that bonus threshold.

It’s like getting free money for spending money I was already going to spend. However just remember to pay it back on time before the due date. Also sign up for cards with No Annual Fees (if you’re just starting)

Why pay for a card when there are so many great no-fee options out there? So banks like Chase and Bank of America if you are living in the U.S both have credit card options of no annual fees. So you can check them out and see which one you prefer.

Strategy 2:

2: Use That Credit Cards for Everyday Expenses

So now you’ve got your credit card—now it’s time to make it work for you. Here’s how you maximize your rewards without spending extra money.

So you’re already spending money on groceries, gas, bills, and even subscriptions, every day or month right?

Why not let those purchases earn you something back? So by having a credit card you can purchase all of your regular expenses on that credit card.

In that way at the end of the month you are saving money with cash back and you are also saving money on the things you buy.

And this is how you can start increasing your financial wellness. Also remember to pay off your spend total in full. This is critical.

Avoid paying any interest by clearing your balance every month before your due date. If you’re not doing this, you’re losing money—not making money.

You can also automate your payments to ensure you never miss a due date, which also protects your credit score and keeps those rewards rolling in.

For example, my card gives me 2% back on groceries. If I spend $500 a month on groceries, that’s $10 back in my pocket. It doesn’t sound like much, but it adds up FAST when you combine it with other categories.

Strategy 3:

3: Invest Your Rewards

Now let’s talk about the fun part—So now you’re earning cashback —great! But the key to turning this into passive income and making more money.

Instead of spending your cashback, you should start investing it. Yup, every time I redeem my cashback, I transfer it straight into an investment account or high yield savings account.

Even if your cash back is just $20 a month, over time, that money grows. For example, if you invest $20 a month with a 7% annual return, in 10 years, you’ll have over $3,000. That’s YOUR credit card working for YOU.

Any money earned can be invested or saved, which indirectly builds passive income.

The secret is consistency. Over time, those small deposits grow, thanks to compound interest. And just like that, your credit card is helping you build wealth.

You might be wondering—why go through all this effort for a few dollars back? Let me tell you: it’s not just about the money.

It’s about building habits, being intentional with your spending, and creating a system that works for you instead of against you.

Once you master this, it’s like unlocking a superpower in your financial life. Now, I’ll be honest—this won’t make you rich overnight. But it’s a simple and effective way to earn extra money with zero effort.

If you’re already spending money on everyday expenses, why not get something back? Over months and years, those rewards add up, and if you invest them wisely, you’ll see real results.

Remember, the goal isn’t just to make money—it’s to use every tool available to build the life you want. And guess what? Even something as simple as a credit card can help you get there.

So if you found this article helpful, share it with a friend who you think may benefit from this information! And if you have any questions or tips of your own? Share them in the comments with me—I’d love to hear from you. And thank you for reading.